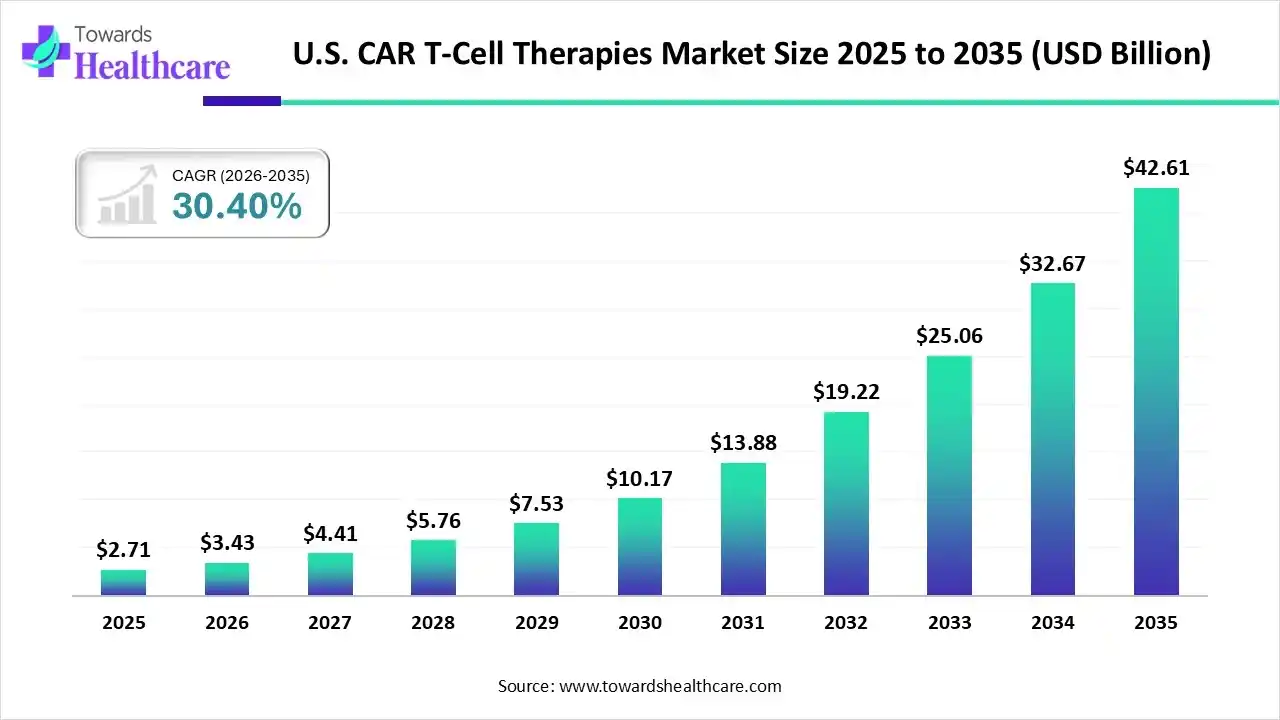

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) -- The U.S. CAR T-cell therapies market size is calculated at USD 3.43 billion in 2026 and is expected to reach around USD 42.61 billion by 2035, growing at a CAGR of 30.4% for the forecasted period. Prospective robust growth will be driven by the rising investments, innovation, and a growing demand across diverse industries.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6340

Key Takeaways

- By drug type, the axicabtagene ciloleucel segment dominated the market in 2024.

- By drug type, the tisagenlecleucel segment is expected to grow at a rapid CAGR in the studied years.

- By indication, the lymphoma segment captured the largest share of the market in 2024.

- By indication, the acute lymphocytic leukemia segment is expected to be the fastest-growing in the coming years.

- By end user, the hospitals segment registered dominance in the market in 2024.

- By end user, the cancer treatment centers segment is expected to witness the fastest growth during 2025-2034.

Expansion of Safety & Specificity: What are the Ongoing Approaches in the U.S. CAR T-cell Therapies?

Primarily, CAR T-cell therapies are a type of immunotherapy that prominently uses a patient's genetically modified T-cells to find and kill cancer cells. Whereas the overall U.S. CAR T-cell therapies market is fueled by a rise in cancer instances, particularly of hematologic cancers, such as leukemia and lymphoma, and the progression of therapeutic applications beyond blood cancers. Consistent developments in this era include novel designs, like bispecific CARs that target two antigens simultaneously to mitigate cancer immune escape, and "logic-gated" CARs with built-in safety switches or "on-off" controls, are in transformation to enhance safety and lower side effects.

What are the Major Drivers in the U.S. CAR T-Cell Therapies Market?

Along with the increasing cancer cases, the market possesses significant factors, including robust investments in research & development, resulting in the development of innovative and more efficacious CAR T-cell therapies. Nowadays, US researchers are fostering groundbreakings in genetic engineering, diagnostics, and manufacturing to optimize the efficiency of CAR T-cell therapies. On the other hand, the emergence of regulatory bodies is helping to raise the number of product approvals for different applications.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drifts in the U.S. CAR T-Cell Therapies Market?

- In October 2025, Wa’ed Ventures, the $500 million venture capital fund backed by Aramco, powered a $10 million Pre-Series A round in Kure Cells, a US-based biotechnology company for evolving faster manufacturing platforms for CAR-T and gene-modified cell therapies.

- In October 2025, Kincell Bio, a major US cell therapy CDMO, partnered with Moonlight Bio, Inc., a Seattle-based biotech company, to revolutionise Moonlight’s lead T cell therapy program into clinic trials.

- In September 2025, Made Scientific, a key U.S.-based cell therapy contract development and manufacturing organization (CDMO), and Hemogenyx Pharmaceuticals plc entered into a manufacturing partnership to boost HG-CT-1, Hemogenyx's Chimeric Antigen Receptor T-cell (CAR-T) therapy.

What is the Developing Limitation in the Market?

Specifically, the accelerating need for higher expenditure for the complex, individualised process, while manufacturing bottlenecks can result in delays. As well as there are a limited number of certified treatment centers and reimbursement policies, especially for programs like Medicaid.

Ongoing Clinical Trials of CAR T Cell Therapy in the US

| Sponsor | Study Name |

| Baylor College of Medicine | Cell Therapy for High Risk T-Cell Malignancies Using CD7-Specific CAR Expressed On Autologous T Cells |

| Baylor College of Medicine | Autologous T-Cells Expressing a Second-Generation CAR for Treatment of T-Cell Malignancies Expressing CD5 Antigen (MAGENTA) |

| University of Colorado, Denver | UCD19 CAR T Therapy in Adults With B-ALL and MRD Positivity in CR1 |

| University of Colorado, Denver | CD19x22 Chimeric Antigen Receptor T-cell Therapy (CAR T) in Pediatric B-ALL |

| BIOHENG THERAPEUTICS US LLC | A Study of CTD402 in T-ALL/LBL Patients (TENACITY-01) |

| PeproMene Bio, Inc. | BAFFR Targeting CAR-T Cells for the Treatment of Relapsed or Refractory B-cell ALL |

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By drug type analysis

Which Drug Type Led the U.S. CAR T-Cell Therapies Market in 2024?

The axicabtagene ciloleucel segment accounted for a dominant share of the market in 2024. Its widespread adoption is driven by its greater efficacy in treating particular, often previously intractable, types of non-Hodgkin lymphoma (NHL), specifically in patients whose cancer has relapsed or is refractory to other treatments. In October 2024, the FDA authorised RMAT designation for axicabtagene ciloleucel as an efficient first-line treatment for adults with newly diagnosed, high-risk large B-cell lymphoma (LBCL).

Moreover, the tisagenlecleucel segment is anticipated to witness rapid expansion. It is mainly approved for pediatric acute lymphoblastic leukemia (ALL) and certain B-cell lymphomas. Currently, the US scientists are continuing analysis of real-world data for both its approved indications (pediatric/young adult B-ALL and adult DLBCL/HGBCL), and persistent research into new CAR-T technologies, including site-specific integration and probably wider applications.

By indication analysis

Why did the Lymphoma Segment Dominate the Market in 2024?

By capturing the biggest share, the lymphoma segment led the U.S. CAR T-cell therapies market in 2024. A prominent driver is a rise in Diffuse Large B-cell Lymphoma (DLBCL). Recent studies are leveraging improvements in delivery methods, such as direct intrathecal administration is being promoted for lymphomas affecting the central nervous system. In May 2025, a study demonstrated that an "armored" CAR T-cell therapy (huCART19-IL18) that secretes the cytokine IL-18 gained a 52% complete remission rate in heavily pre-treated lymphoma patients. By 2030, there will be a rise in nearly 108,000 new NHL cases in the U.S. is predicted.

Whereas the acute lymphocytic leukemia segment will expand rapidly. In 2024, the American Cancer Society anticipated that about 6,550 new ALL cases would be diagnosed annually in the U.S. Recently, the US FDA approved CD19-targeted therapies, particularly Kymriah (tisagenlecleucel) and Tecartus (brexucabtagene autoleucel), for relapsed/refractory B-cell ALL. The widespread researchers are involved in the development of methods to generate CAR T-cells inside the body, instead of manufacturing them ex vivo.

By end user analysis

Which End User Dominated the U.S. CAR T-Cell Therapies Market in 2024?

In 2024, the hospitals segment held a major share of the market. Particularly, University Hospitals (UH) Seidman Cancer Center, Stanford Health Care, UPMC Hillman Cancer Center, Mass General Brigham Cancer Institute, and Rutgers Cancer Institute are immensely adopting and developing these advanced therapies. Whereas UPMC Hillman Cancer Center is the most experienced provider of FDA-approved CAR T-cell therapies in western Pennsylvania, they have treated over 100 patients.

Although the cancer treatment centers segment is estimated to expand fastest. Like MD Anderson Cancer Center, HCA Healthcare's Sarah Cannon Cancer Institute, and many other research and treatment centers, are fostering the acceleration of the use of CAR T-cell therapy to numerous cancer types, such as a variety of blood cancers and solid tumors. Alongside, they are leveraging efforts in the study of target proteins found inside cancer cells, beyond surface proteins, which could offer novel treatment alternatives.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What are the Recent Developments in the U.S. CAR T-Cell Therapies Market?

- In November 2025, UCI Health introduced a clinical trial to test an investigational cell therapy for lupus, with the probable of giving patients long-term remission of symptoms.

- In October 2025, Citius Oncology, Inc. finalized an exclusive agreement with EVERSANA to assist the estimated fourth quarter 2025 U.S. commercialization of LYMPHIR (denileukin diftitox-cxdl), Citius Oncology's FDA-approved therapy for relapsed or refractory cutaneous T-cell lymphoma (CTCL).

- In October 2025, Citius Oncology, Inc. entered into a distribution services agreement with McKesson Corporation to explore as an authorized distributor of record for LYMPHIR (denileukin diftitox-cxdl), a new immunotherapy approved for adult patients with relapsed or refractory Stage I-III cutaneous T-cell lymphoma (CTCL).

U.S. CAR T-Cell Therapies Market Key Players List

- Johnson & Johnson Services, Inc.

- ALLOGENE THERAPEUTICS

- Lonza

- Aurora Biopharma

- Cartesian Therapeutics, Inc.

- Novartis

- Bristol-Myers Squibb company

- Gilead Sciences

- Curocell Inc

- JW Therapeutics

Browse More Insights of Towards Healthcare:

The global cell therapy raw materials market size is calculated at US$ 5.43 in 2024, grew to US$ 6.75 billion in 2025, and is projected to reach around US$ 48.54 billion by 2034. The market is expanding at a CAGR of 24.5% between 2025 and 2034.

The global cell therapy packaging market size is calculated at USD 400 million in 2024, grow to USD 446.96 million in 2025, and is projected to reach around USD 1213.8 million by 2034. The market is expanding at a CAGR of 11.74% between 2025 and 2034.

The global cell therapy manufacturing market is estimated to grow from USD 6.12 billion in 2025 at 16% CAGR (2025-2034) to reach an estimated USD 23.27 billion by 2034.

The global cell therapy media market size is calculated at USD 1.34 billion in 2024, grow to USD 1.49 billion in 2025, and is projected to reach around USD 3.83 billion by 2034.The market is expanding at a CAGR of 11.14% between 2025 and 2034.

The global cell therapy market size was estimated at US$ 7.21 billion in 2025 and is projected to grow to US$ 44.39 billion by 2034, rising at a compound annual growth rate (CAGR) of 22.69% from 2024 to 2034.

The global cell therapy human raw materials market size was estimated at US$ 2.91 billion in 2023 and is projected to grow to US$ 22.75 billion by 2034, rising at a compound annual growth rate (CAGR) of 22.38% from 2023 to 2034.

The global CAR-T Cell Therapy Isolator Market is on a strong growth path, expected to witness substantial revenue expansion, potentially reaching hundreds of millions between 2025 and 2034.

The global placental stem cell therapy for neurological disorders market size is calculated at US$ 453.4 million in 2024, grew to US$ 535.63 million in 2025, and is projected to reach around US$ 2366.97 million by 2034. The market is expanding at a CAGR of 18.14% between 2025 and 2034.

The global automated and closed cell therapy processing systems market size is calculated at USD 1.45 billion in 2024, grew to USD 1.74 billion in 2025, and is projected to reach around USD 8.86 billion by 2034. The market is expanding at a CAGR of 19.84% between 2025 and 2034.

The global stem cell therapy market size is calculated at USD 613.7 million in 2025, grew to USD 768.72 million in 2026, and is projected to reach around USD 5835.53 million by 2035. The market is expanding at a CAGR of 25.26% between 2026 and 2035.

Segments Covered in the Report

By Drug Type

- Axicabtagene Ciloleucel

- Tisagenlecleucel

- Brexucabtagene Autoleucel

- Others

By Indication

- Lymphoma

- Acute Lymphocytic Leukemia

- Chronic Lymphocytic Leukemia (CLL)

- Multiple Myeloma (MM)

- Others

By End User

- Hospitals

- Cancer Treatment Centers

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6340

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest